Top Investment Sectors to Watch in 2025: Key Trends and Insights

New year, new possibilities! With this motivation, the global economy continues to evolve. Technological advancements are occurring every day, consumer behavior is shifting, and the emphasis on building a greener planet is stronger than ever. As a result, certain sectors are expected to thrive in the coming year.

Whether you’re a seasoned investor or just starting out, understanding these trends can help you make important financial decisions that can maximize your returns.

Here’s a look at the most promising investment sectors of 2025 and why they deserve your attention.

1. Renewable Energy

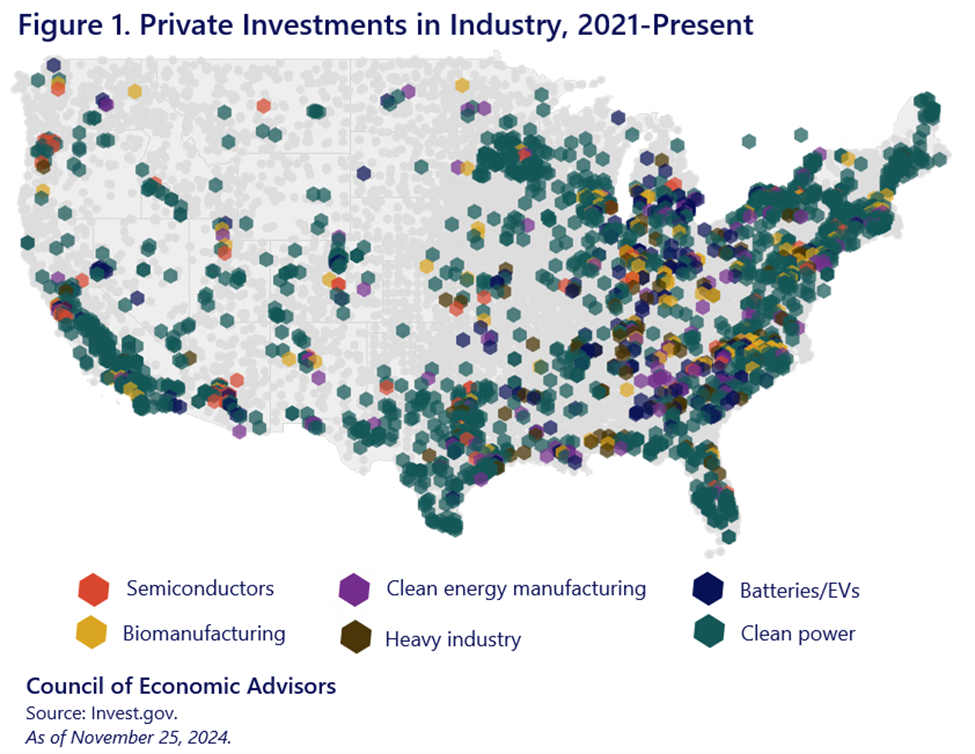

Needless to say, climate change remains to be one of the prominent global concerns. Renewable energy continues to be a key area of focus for governments and businesses across countries. The transition from fossil fuels to solar, wind, and hydrogen is gaining momentum, powered by international agreements and ambitious net-zero goals.

Therefore, investing in solar panel manufacturers, wind turbine companies, and energy storage solutions should be fruitful and bring significant returns as demand for clean energy would only grow. Also, companies innovating in electric vehicle (EV) infrastructure, such as charging networks, are also likely to benefit from increased adoption.

2. Artificial Intelligence and Automation

AI is no longer a futuristic concept. It is the present. It is transforming industries in real-time. From healthcare and finance to retail and manufacturing, AI and automation are bringing up new possibilities.

In 2025, companies specializing in AI-driven software, robotics, and machine learning tools might see a robust growth. Infact, sectors like autonomous vehicles and AI-powered customer service solutions are attracting significant investments. Focus on companies with innovative products and scalable business models.

3. Healthcare and Biotechnology

Even though the healthcare sector has always been a strong contender for investments, COVID-19 further boosted the sector by transforming the way we look at healthcare. Also, recent breakthroughs in biotechnology and personalized medicine have taken it to next level.

Look out for companies focusing on:

-

Telemedicine and remote healthcare solutions.

-

AI-driven diagnostics and drug discovery.

-

Biotech firms with strong R&D pipelines.

With an aging population and increasing global healthcare needs, this sector remains to be a reliable choice for long-term investments.

4. Fintech

The fintech sector has reshaped the way we manage money, access credit, and make payments. With advancements in blockchain, digital wallets, and decentralized finance (DeFi), fintech is surely catching eyeballs.

Key areas to watch out:

-

Payment processing platforms.

-

Blockchain-based financial solutions.

-

AI-powered credit scoring and lending platforms.

5. Sustainable Consumer Goods

According to a survey on consumer sentiment by PwC India, 60% of Indian consumers actively choose sustainable products. As more people prioritize sustainability in their purchasing decisions, companies are innovating with eco-friendly products. From plant-based foods to sustainable fashion, businesses that align with this trend are thriving.

You can explore opportunities in:

-

Companies offering eco-friendly packaging solutions.

-

Brands specializing in organic and plant-based food products.

-

Sustainable fashion labels and second-hand retail platforms.

As this trend gains momentum, businesses that balance profitability with environmental responsibility are likely to emerge as leaders.

Investing is about identifying long-term opportunities that align with your financial goals. With careful planning and a focus on promising sectors like renewable energy, artificial intelligence, and fintech, 2025 could be your year of growth and prosperity.

link