Why Decoding Market Psychology Is Key To Investing Success

Mihaela Rosu

Market psychology is an intricate subject matter that investors often neglect or lump together with technical analysis and sentiment indicators. Failure to adequately grasp and appreciate the potential impact of market psychology on prices, however, could be detrimental to investment decision-making.

Many long-term investors simply ignore market psychology altogether and focus on investing in great businesses. Similarly, value investors are often prepared to wait up to several years for markets to validate their stock picks, thus allowing them to ignore fleeting sentiment.

However, traders and active investors usually have little choice but to wrestle head-on with market psychology from day to day.

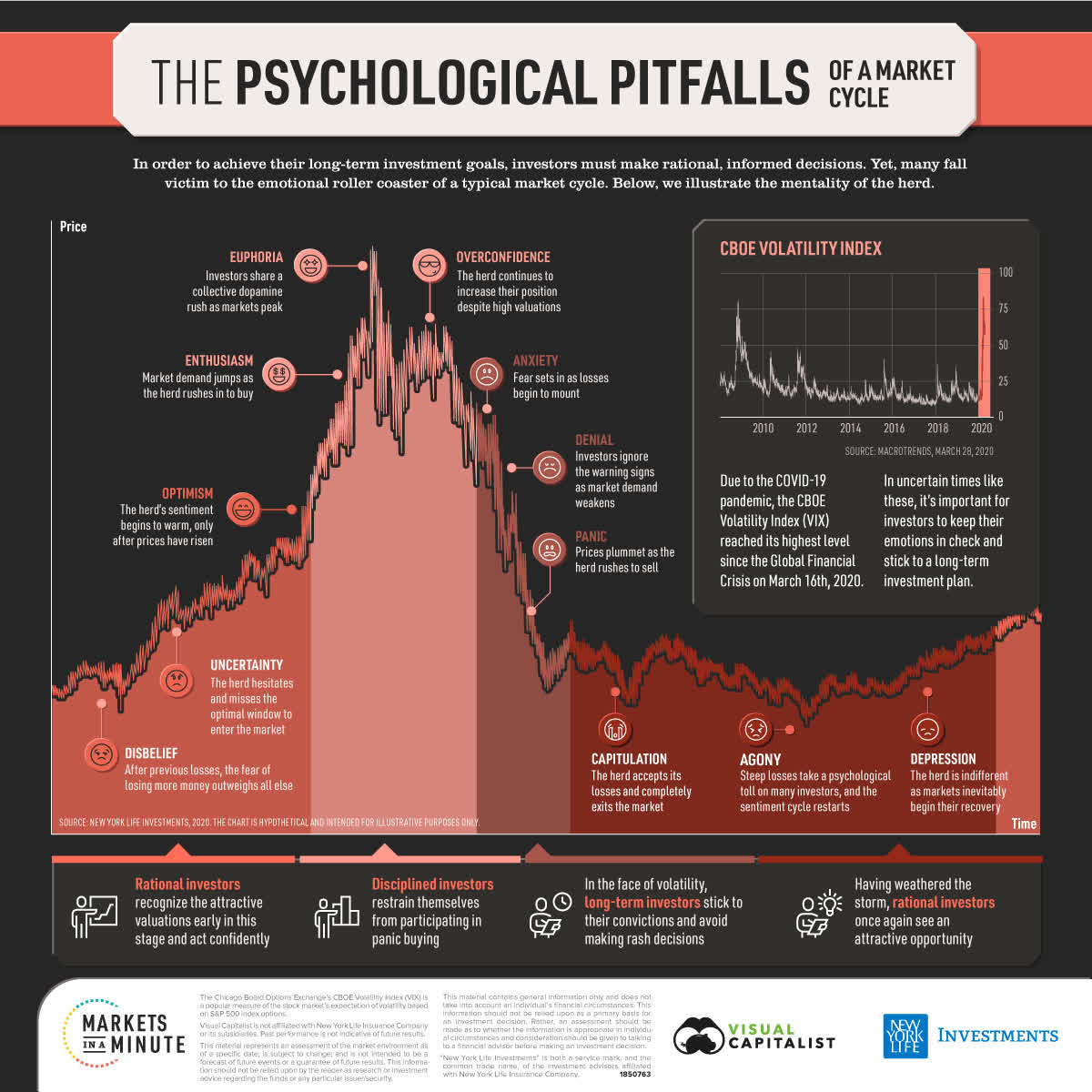

New York Life Investments, Visual Capitalist

Here at Stratos Capital Partners, we firmly believe that decoding market psychology is critical to navigating financial markets and achieving investing success. Regardless of whether you are a long-term value investor or a day trader, getting a good read on prevailing market sentiment could certainly improve your odds of success.

In this article, we shall discuss market psychology and its potential impact, why sentiment predominantly determines prices in the short term, and how to take advantage of extreme sentiment to enhance portfolio alpha.

The Desire For Order Versus Randomness In Prices

Ever picked up a trading strategy that promises to profit consistently from some sort of predictable price action, but it just didn’t work at all? Or perhaps the strategy worked really well in the beginning but suddenly lost its magic just when you thought you had found the holy grail? While some traders quickly blame the strategy and move on in search of the next one, others may decide to spend more time (potentially several years) refining their strategies. Unfortunately, the vast majority of traders will never find lasting success. But why is that so?

In our opinion, the biggest hurdle to becoming a successful trader/investor is learning to appreciate the often volatile and random nature of financial markets. The epiphany that unpredictable price action is a characteristic of financial markets and that sentiment on aggregate (rational or otherwise) determines price in the short term, marks a major milestone on the journey to becoming a successful trader/investor.

The seemingly irresistible promise that one can look for patterns in past prices to predict market direction with a high level of precision is simply wishful thinking. From our experience, loose and crude predictions of where markets are headed (e.g., trend-following or momentum strategies) often tend to be more reliable than high-precision strategies.

In reality, random transactions by large institutional investors regularly move prices one way or the other. Million-dollar transactions are regularly executed just because some portfolio manager is performing a prescheduled rebalancing of the portfolio. That means the next time we see a big order come in, it may not mean anything at all. Just transactional noise, some would call it. Material news, which is unpredictable, also moves prices as the news gets digested by the market. Separate groups of investors with conflicting views are always in a never-ending contest to nudge prices, and from time to time, some groups exert more influence on prices than others. There are also investors who are temporarily observing from the sidelines, but may re-enter the market without notice. Even the occasional “fat finger error” can move prices in unpredictable ways.

Therefore, no single chart pattern or indicator can precisely signal in advance when any of these random events will happen and how they will impact prices in the immediate future. Even if some trading strategy is indeed capable of identifying profitable price action in the past, there is still no way to avoid false signals caused by random events in the future.

The biggest misconception in trading is perhaps the idea that there is always some kind of “meaning” or “psychology” behind any price action, especially in really short trading time frames. It could very well be randomness at work.

Of course, this does not mean that all traders are destined to fail. We believe that most traders fail just because they fail to grasp market psychology and its potential impact on prices.

Irrational Behavior Is Why Most Traders Fail

For as long as financial markets have existed, defeated investors have often blamed the market for its irrational behavior whenever it failed to meet their expectations. Many try to explain away the market’s irrational behavior simply by labeling it as irrational exuberance, while others try to decipher that behavior by distinguishing between retail trading flows and “Smart Money” flows. More recently, companies that have gained a cult-like following among amateur investors have even been categorized as “Meme Stocks”. Apparently to some, stocks that fall into this special category are condemned by true investors and deemed reserved for irrational people only.

Below is a great example of irrational behavior. Back in 2020, speculators were ridiculed for driving up the stock price of Tesla (TSLA) by 40% in the lead-up to a five-for-one stock split. All kinds of ridiculous arguments were offered as to why TSLA deserved to be priced 40% higher in the lead-up to the stock split. A separate report by Barron’s showed that TSLA had actually surged by as much as 80% in the three weeks just before the stock split.

X/Twitter

Irrational or not, many successful traders and investors understand and accept the fact that the market will regularly do the unpredictable. What seems inevitable is that irrational market behavior will break most trading strategies. Regardless of how irrational and silly market sentiment may be from time to time, it ultimately decides where prices will go in the short term.

Aggregate market sentiment, not fundamentals or technicals, is the key determining factor for where prices will be at any moment. The most challenging part is figuring out the current sentiment driving markets and anticipating when it will swing the other way. Thinking that some simple indicator or chart pattern is going to figure all that out is a recipe for disaster.

Although fundamentals determine future economic benefits and should theoretically serve as an anchor for where current prices ought to be and limit how far prices can stray, it is simply unrealistic to assume that all market participants are fundamental investors who will act rationally at all times. The reality that speculators of all kinds and temperaments will always be an inseparable part of financial markets cannot be ignored. A good fundamental investor should recognize that markets will be irrational from time to time. What matters is how one is going to respond to irrational markets.

Proponents of technical analysis often claim that price action reflects aggregate market sentiment. That is true only to a certain extent. Although some market participants may choose to trade specific time frames exclusively (tick data, hourly data, or end-of-day), many others are free to execute trades any time they wish and based on price data of any time frame. Therefore, analyzing price action within a narrow or specific time frame fails to adequately capture aggregate market sentiment. Moreover, due to random future events and fickle market sentiment, past measures of sentiment have little predictive power over future prices. Indeed, building an effective trading strategy is a lot more sophisticated than most people think.

But if one were to accept the reality that market behavior will be irrational from time to time and therefore unpredictable, how does one even begin to trade or invest?

How To Thrive In Irrational Markets

Veteran traders who have consistently beaten the market over multiple market cycles understand irrational markets. They accept that even the best trading strategies will only work some of the time. They accept that random price action and irrational markets are going to give false signals that will eat away at their capital.

One solution to overcoming irrational markets is to fully embrace them and think probabilistically about the business of trading. Systematic traders design strategies that accommodate the random aspects of prices and irrational markets while still preserving a statistical edge that will generate market-beating returns over a large number of trades. Successful systematic traders accept drawdowns as part and parcel of any trading strategy and plan ahead to weather those drawdowns.

Some of the most successful hedge funds, including Millennium Management and Citadel, have taken a few steps further. By running a large and diversified portfolio of high-performing trading strategies, these multi-strategy hedge funds seek to generate consistent alpha without concentrating on just a handful of styles or strategies. The idea is simple yet powerful: by combining a large number of uncorrelated trading strategies that generate alpha, multi-strategy hedge funds effectively neutralize the occasional and uncorrelated drawdowns of individual strategies. The concept is essentially the same as diversifying one’s portfolio with multiple assets.

But do not feel discouraged if you are just a regular investor without a multi-million-dollar capital base or are simply not keen on running multiple trading/investment strategies. Fortunately, there are other alternative paths to successful investing.

Irrational Markets Don’t Last

One thing we can be certain about irrational markets is that they do not last very long. Time and again, asset bubbles inevitably burst as reality eventually catches up to unrealistic expectations. Prices of undervalued assets eventually adjust to reflect their true value as rational investors continue to buy up discounted assets (provided that fundamentals do not deteriorate over time).

The key deciding factor for investing success here is time. Long-term investing is simple yet so effective that insurance companies, pension funds, trust funds, and endowment funds have been relying on it to generate consistent returns for decades.

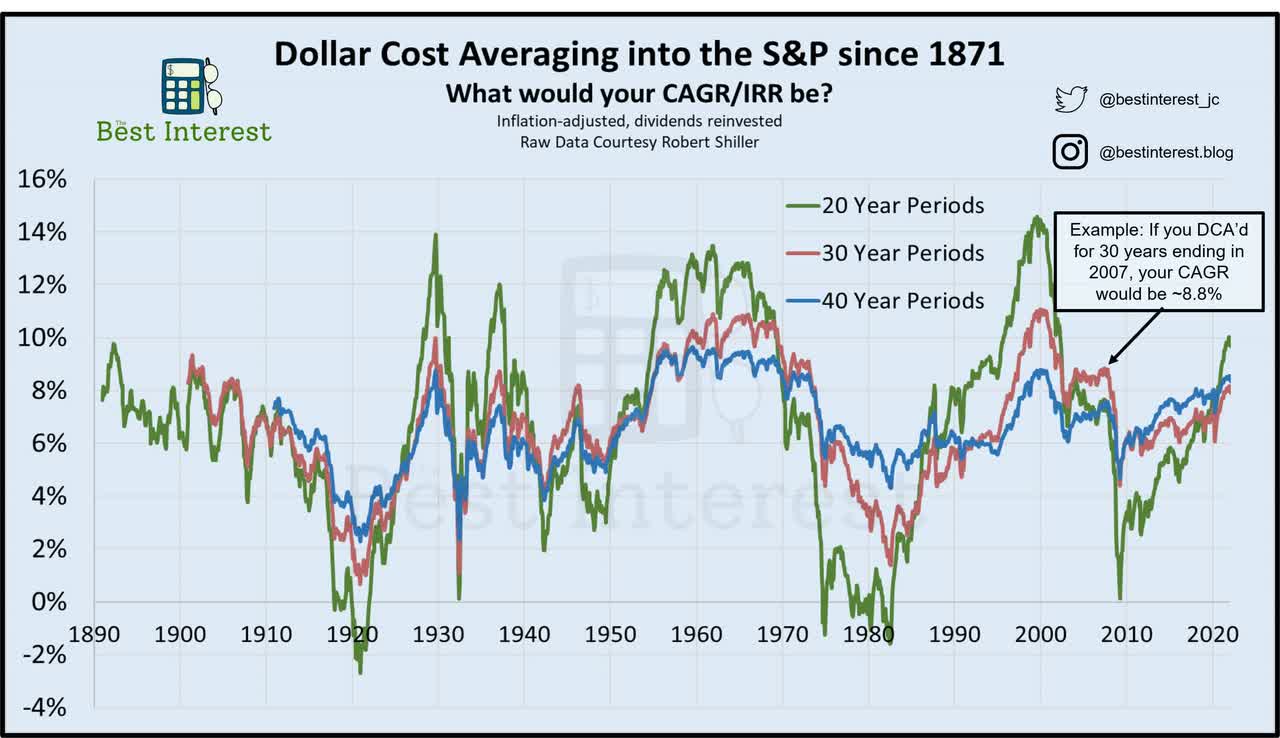

The diagram below demonstrates the performance of a passive Dollar-Cost Averaging strategy that regularly invested a fixed dollar amount in the S&P 500 (SPX). Notice that a long-term investor would have made a decent return even if he had terrible timing and started Dollar-Cost Averaging at a market peak (2007).

The Best Interest

Understanding Behavioral Biases & Heuristics

For readers who are neither interested in running multiple strategies nor willing to commit to a long investment horizon, the only alternative is to confront irrational markets head-on. But in order to do so successfully, one should, at the very least, understand the source of irrational markets.

Behavioral finance, which studies investor behavior and the role our emotions can play in investment decisions, has produced significant breakthroughs and gained widespread recognition over the past two decades. Researchers have identified and documented a long list of cognitive biases and heuristics that help explain irrational investor behavior. Popularized by best-selling authors including Daniel Kahneman, Amos Tversky, Richard Thaler, and Nassim Nicholas Taleb, behavioral finance has established itself as a foundational subject for Wall Street analysts and professional investors.

However, formal scientific studies of market psychology still seem to be lacking in certain ways. Although understanding how cognitive biases undermine decision-making may help investors be more self-aware of these pitfalls, research has also shown that these biases are deeply rooted in our subconscious mind. Attempting to overcome some of our biases may be much more difficult than we think.

Decoding Market Psychology And Taking Advantage Of Irrational Markets

To better manage irrational markets and avoid cognitive pitfalls, we believe investors should simplify the problem rather than tackle it head-on. Instead of trying to measure market psychology with laser-sharp precision or resist committing a lengthy list of cognitive biases themselves, investors can instead rely on simple rules of thumb.

One rule of thumb for identifying irrational market behavior is to look for symptoms of extreme sentiment. Investors can then avoid trading in the same direction. The idea is simple: avoid chasing the hottest stock, be careful when the vast majority are overwhelmed by greed and becoming overconfident, and consider taking risks when the vast majority are crippled by fear.

Periods marked by extreme sentiment are aplenty. Remember in late 2022, when almost every Wall Street analyst, CEO, finance minister, and financial media outlet was certain the U.S. was headed for a recession? How about when Russia invaded Ukraine, and everyone was worried that Europe would face an energy crisis and that natural gas prices would continue to soar? How about the euphoric rise of cryptocurrencies in 2021, followed by the spectacular collapse in 2022, and then a resurgence again in 2023? Each time, these episodes were accompanied by extremely bullish/bearish sentiment.

Contrarian investors thrive by trading against prevailing market sentiment, especially when sentiment is extreme. Contrarians often prefer to wait patiently for market sentiment to reach an extreme before initiating trades to position for a reversal. Doing so significantly improves their chances of getting their trades off to a good start (markets tend to revert to the mean). Another reason is that the opportunity for outsized gains tends to come when market sentiment has reached an extreme and is about to swing forcefully in the other direction.

There is one important caveat. Optimism and pessimism tend to work very differently in financial markets. There is often a limit (a lower bound for prices) to how pessimistic markets could get, but the limits of optimism have too often been greatly underestimated.

In most cases, there is a lower bound as to how far asset prices could fall. In the case of equities, as long as a company is still solvent, there must be a liquidation value for the stock. This liquidation value is underpinned by the value of the assets sitting on the company’s balance sheet, which can be sold for cash and used to pay off liabilities. Should a company’s stock price fall below its liquidation value, corporate raiders can effectively arbitrage by buying up the company and liquidating it immediately for a profit (after factoring in transaction costs). On the other hand, there is no theoretical limit to how high asset prices can go. So long as there is a greater fool who is willing to offer a higher price, there will be a seller willing to transact.

Once again, this is why some of the most successful investors practice value investing and have withstood the test of time, while very few, if any, have built a fortune by consistently shorting overvalued stocks. Becoming a value investor means learning to identify value and buying an asset at a reasonable price, or preferably at a deep discount.

Value investing means understanding that the market can be irrational and crazy from time to time but will eventually come to its senses. Short-selling, on the other hand, means fighting the market when it is irrational and crazy and then hoping that it doesn’t get too crazy before it comes to its senses.

Till Next Time When Sentiment Is Extreme Again

In the interest of keeping this article within a reasonable length, we decided to selectively focus on what we think are the most critical elements of market psychology. There is much more to discuss and learn about market psychology, and we highly encourage aspiring traders and investors to read deeper into this fascinating subject.

At Stratos Capital Partners, we search relentlessly for the best investment and trading ideas that offer incredible risk-reward profiles. And many of our best calls have been made when market sentiment is extreme. We regularly share our thoughts on the market psychology driving markets and how we take advantage of irrational markets to extract alpha.

So stay tuned for more!

link